ChargeAfter expands embedded lending network with Snap Finance partnership

ChargeAfter, the embedded lending platform for point-of-sale financing, have announced it has partnered with Snap Finance, a fast, flexible pay-over-time financing option provider. The collaboration strengthens ChargeAfter’s subprime lender coverage, equipping merchants with additional options to better support customers who are likely to be declined for traditional financing or credit models.

Snap Finance offers consumers who are establishing or rebuilding their credit access to lease-to-own and subprime installment programs. Approximately 57 million Americans hold subprime credit ratings emphasizing the market need for subprime purchase provision solutions.

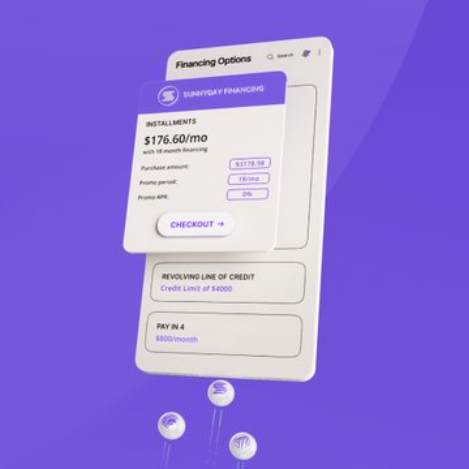

The integration of Snap Finance into ChargeAfter’s network enables merchants to provide instant no-credit-required financing options through a seamless waterfall experience at the point of sale. This is crucial for retailers and service providers in home goods, aftermarket auto and service, and beyond to improve approval rates and drive revenue growth. Snap Finance is the latest lender to join ChargeAfter’s network which incorporates a diverse range of point-of-sale financing options, catering to the entire credit spectrum through a full point-of-sale financing waterfall.

Cooper Blackhurst, SVP of Strategic Partnerships at Snap Finance, commented, “Snap Finance is thrilled to partner with ChargeAfter to help merchants deliver our financing options to an underserved consumer segment. Snap’s recent research found 44% of credit-challenged consumers avoid retailers that don’t offer point-of-sale financing, demonstrating the importance of full financing credit coverage for merchants and their customers. Our partnership with ChargeAfter enables us to connect with credit-challenged consumers at their moment of need through an upgraded experience that requires a single application and delivers instant notification of approval.”

Meidad Sharon, Founder and CEO of ChargeAfter added, “We are delighted to partner with Snap Finance, a leading provider of no credit required point-of-sale financing options. This collaboration not only enhances our network of lenders, but also reinforces the value that ChargeAfter delivers to merchants and their customers. By expanding our network, merchants have an additional option to cater to their entire customer base and achieve approval rates of up to 85%, boosting sales and fostering customer loyalty”.