Carrington Labs announces expansion into US banking market with the signing of Utah-based CCBank

Carrington Labs has expanded into the US banking market to provide credit‑risk‑modeling and cash‑flow‑underwriting services to CCBank.

Regions Bank selects Axway to accelerate open banking services

Regions Bank have announced it has selected Axway and its Amplify Open Banking solution, to deliver future open banking capabilities.

Higo Bank selects DTCC’s ITP services, streamlining and accelerating post-trade processing

DTCC announced today that Japan’s Higo Bank has adopted DTCC’s ITP services to automate their middle and back office.

J.P. Morgan taps Quest Payment Systems’ payments technology to enhance in-store merchant capabilities

Quest Payment Systems have announced enhanced retail merchant capabilities for their Australian customers, supported by J.P. Morgan Payments technology.

Avidia Bank partners with Q2 and Personetics to modernize its digital banking experience

Massachusetts-based Avidia Bank has selected Q2 to modernize and enhance its digital banking experience for its customers.

Rich Data Co signs first US customer as part of global expansion and transformation of business lending leveraging AI

Rich Data Co, a leader in AI decisioning for business and commercial lenders, has signed its first major US deal with M&T Bank Corporation.

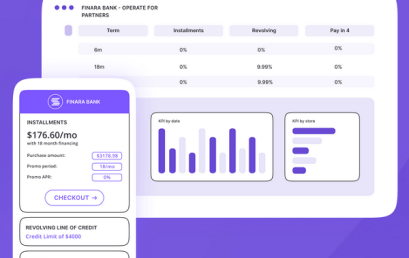

US fintech ChargeAfter unveils The Lending Hub platform to revolutionize banks’ embedded lending capabilities

ChargeAfter have unveiled The Lending Hub, a platform that transforms how banks deliver lending solutions for merchants and their customers at scale.

i2c and The Bank of Missouri partner to empower US fintechs to launch digital banking products

i2c have announced a five year partnership with The Bank of Missouri, the community bank renowned for its pioneering digital banking initiatives.