Global X ETFs celebrates crypto success as Ethereum ETFs enter the US market

Global X ETFs, the first provider of spot cryptocurrency ETFs across the Asia-Pacific region, welcomes the US SEC decision to introduce Ethereum ETFs.

DTCC survey identifies significant improvements in industry understanding and preparedness around expanded U.S. Treasury Clearing

“The U.S. Treasury Clearing Mandate: An Industry Pulse Check” will further enhance the industry’s knowledge of the SEC’s expanded clearing rules.

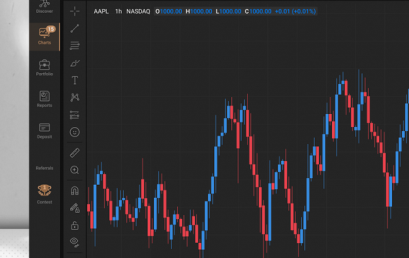

Capital.com partners with TradingView to offer clients enhanced trading tools

Capital.com have announced it has partnered with TradingView, the world’s leading provider of charting and analytical trading tools.

DTCC’s FICC launches CCLF public calculator to support expansion of U.S. Treasury Clearing

DTCC today announced the launch of FICC’s interactive, public-facing Capped Contingency Liquidity Facility (CCLF) Calculator.

DTCC and Cboe Clear Europe to introduce new clearing workflow for OTC cash equities trades

DTCC today announced it is working with Cboe Clear Europe to deliver an enhanced post-trade workflow for over-the-counter cash equities trades.

ICI, SIFMA and DTCC comment on the U.S. move to T+1

ICI, SIFMA, and DTCC thank all the stakeholders for their collaboration and support in successfully implementing this historic change to U.S. markets.

DTCC’s FICC Treasury clearing activity expected to increase by over US$4 trillion daily

DTCC have announced that daily Treasury volumes through its Fixed Income Clearing Corporation are expected to rise by over US$4 trillion.

DTCC comments on the industry’s T+1 progress

T+1 was introduced in the U.S. on Tuesday, May 28, and the industry has been operating on an accelerated settlement cycle since that time.