US fintech startup CabbagePay launches to redefine the way money moves

US fintech startup CabbagePay has officially launched in major US cities with its goal to redefine the way money moves for all businesses, as it continues to penetrate brands, stores, websites, and apps.

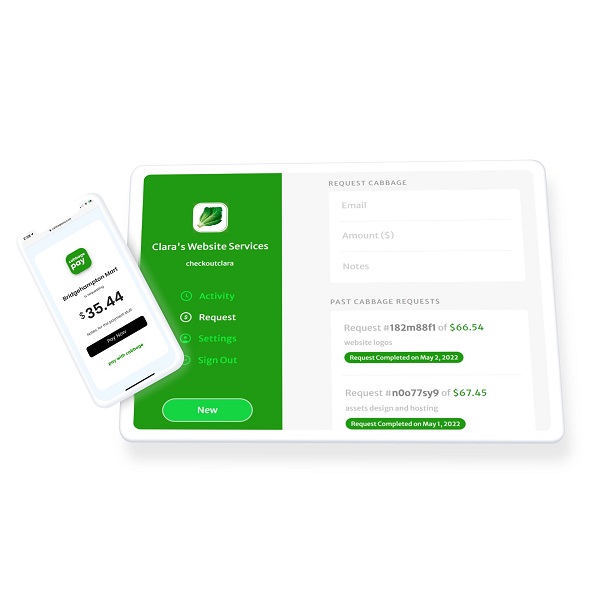

CabbagePay is growing rapidly due to its cost-effective payment rails and myriad use cases in all walks of industries from retail, freelancing to healthcare, finance. The company allows platforms to integrate prebuilt CabbageLink technology into mobile apps, and online stores to make payments cost-effective without ever leaving the platform’s brand experience.

“Moving money is plagued with an excess of fees, fraud, delay. Checkout times everywhere have been more frustrating than ever due to the pandemic and merchants are paying tens of thousands of dollars in credit card fees. CabbagePay is capitalizing on this untapped market,” said Pratt Khot, Co-Founder of CabbagePay. “Our unified Cabbage API supports all tech teams to get setup with less than 5 lines of code.”

With CabbagePay, businesses are significantly saving on payment transaction fees, thus turning those savings towards the customers. For frequent purchase businesses like gas stations, grocery stores, etc. significant gains are accumulated over time when regular customers switch to CabbagePay from credit cards, making the discounts, cashbacks well worth it. Businesses are incentivizing customers to switch to CabbagePay by offering bonuses, one-time discounts. Cabbage App offers customers the quickest way to pay at retail stores by utilizing transient code technology.

“We have built a foundation to take on a serious chunk of the total addressable market(TAM) in the US,” said Pratt Khot, Co-Founder. “Card payments industry in the US is the biggest market of all, and we are poised to grab this opportunity.”