Nav unveils new brand experience delivering more transparency into financial health for SMBs

The new experience builds momentum for small business owners by providing the most comprehensive, transparent, and relevant destination for small business financial health.

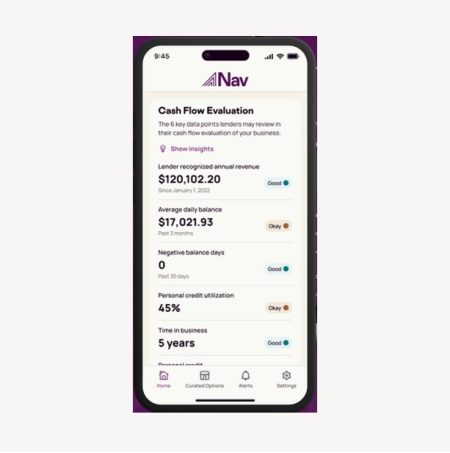

Nav, the leading financial health platform for small businesses, today reveals a new brand identity and improved experience including an all new mobile app. The refresh improves the way Nav helps small businesses keep a pulse on their financial health with enhanced financial health evaluation tools, dynamic options based on realtime business data, and insights that help business owners clearly understand and act on their best financing options.

With the new look comes more relevant financing options and improved features that help small businesses understand and anticipate their cash flow, evaluate their most relevant financing options, and access an expanded network of business services like accounting, payroll, and tax services.

Nav users now have even more transparency on how their qualifications impact their available financing options. They’re also able to see what they can qualify for before they apply, and get insights on how to re-qualify for options they’ve been declined for. The changes make Nav the only platform for a business owner to see personal and business credit information, cash flow insights, and their most relevant financing options in one place.

“Small businesses need relevant solutions more than ever before. Our new experience reinforces Nav as the destination for small business owners who want a trusted partner to help them navigate financing options, business services, and more,” says Nav VP of Marketing, Nick Guerrieri.

Nav partnered with San Francisco agency Barrett Hofherr for development of the new visual identity system. “Nav’s mission is bold. Their personalized, data-driven approach to small businesses meant we needed to create a dynamic brand identity that translates across every touchpoint,” said Ted Bluey, Head of Design at Barrett Hofherr.

Nav has over 1.7 million users, and has shown impressive growth fueled by development of cash flow insights, an integrated checking account, as well as curated insurance, business formation, payroll, merchant services, and accounting services, all tailored to individual users’ needs.